Phase

Startup & Employment to Entrepreneurship

Growth Phase

Acceleration Phase

Market Changes/Mergers

Consolidation

Termination/Transition

Goal

Cash Generation

Break Even

Investment/Transformation

Business Transformation

Cash Outflow

Resource Preservation

Mistake #1 – They don’t follow a clear business model

It seems straightforward, but many companies DO NOT follow a business model, and as a result, can get themselves into trouble. A business model is a theoretical way to balance your revenue generating strategies with the appropriate resources to deliver them.

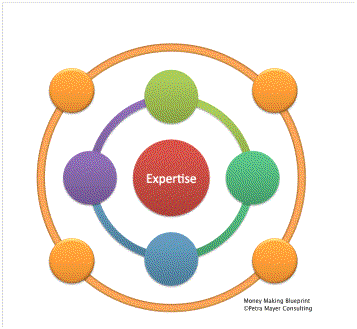

When explaining this analogy to clients, I like to use the following diagram:

When you are creating your business model, the revenue side of your business model should be centered around your area of expertise, so you should be very clear on this area and how you use it to serve your clients.

The next step is to place your own services and products in the smaller circle and the strategies of selling other peoples’ services and products and ancillary sales on the outer circle.

Ancillary sales are generated from goods or services that differ from or enhance the main services or product lines of a company. This combination will give you a balanced approach to your money. Using a model creates structure and focus when building a business strategy.

Before you determine the resources you will need to execute your strategies, you should develop a timeline. It’s important to consider what resources you will need to deliver these strategies, including any services you may have to outsource.

If you have an online company, there are certain considerations you have to take into account. The online environment requires systems such as email auto-responder, shopping carts, landing pages, cloud storage and a well-designed website. If you offer an online course, you might also need a course hosting platform, and webinar or conference calling software. Some of these are free or low cost but others can be a substantial investment. By determining this at the start, this will allow you to bring in the resources at the time you really need them rather than paying for systems you don’t need.

When I work with my clients, I use a visual diagram to schedule the strategies and resource requirements over a three-to-five year period. This gives them direction and clarity on their path through this business transition.

Mistake # 2 – They don’t balance cash flow strategies with business transformation strategies

As an entrepreneur, when your business goes through a transformation - for example if you are moving from employment to entrepreneurship, or you are shifting your services - you will need to consider how you can maintain your income while building the business you are aspiring to build. It comes down to balancing your income with your transformation. This scenario is impacted by your financial situation and your risk comfort level.

It’s simply a time vs. money scenario. If you have time on your hands, you can use it to generate more immediate cash flow. This will raise your income now and allow you to incorporate your business transformation strategies. If you are making substantial money but you are running out of time to create the business you are aspiring to, you might want to shift and reduce your cash generating strategies and work on your business transformational strategies.

Mistake #3 – They don’t ask for help

Entrepreneurs, particularly those staring out, think that they have to do everything for their business themselves. This need is often based on a position of scarcity. I suggest that entrepreneurs consider multiple ways of getting help when starting a business. Outsourcing is one of them.

I have created an Outsourcing Calculator that I provide my clients that I coach. It helps them to prioritize what to outsource and what to do themselves. [Tweet "As @SandraYancey says: “Do only what only you can do!”"]

In addition to outsourcing, follow thought leaders in your industry, join programs or work with a coach or accountability partner to shorten the learning curve and move your business forward faster. Consider this as an investment in your business AND your sanity!

| Outsource | Get Support |

Do only what only you can do | Follow thought leaders |

Outsource what needs to be done | Work with a coach or accountability partner |

Take off your list what has no impact | Ask for support in your network, family and friends |